How Bitcoin transaction fees work

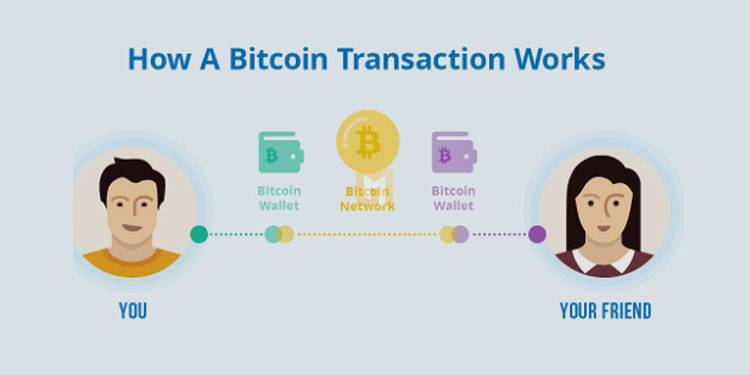

Bitcoin was created as an upgrade to the old financial system, giving more people access to banking services and making transactions faster and cheaper. However, sending Bitcoins is not free and costs may vary depending on the method used and the priority of speed. To demystify what can be a confusing topic, we’ve put together a beginner’s guide to Bitcoin transaction fees.

The idea that making a money transaction with regular money – dollars and euros – might incur costs shouldn’t be new to anyone, less obvious is what you’re actually paying for.

How much do traditional financial transactions cost

Today’s financial system is centralized, so transferring money only requires debiting a balance from computer A and crediting a balance from computer B, although there are actually several leaps in between.

When you make a Visa transaction, both you and the receiving merchant pay a fee. You are not aware of it, but it is built into the price of the good or service. The actual cost of the transaction is small and decreases as the number of Visa users increases, so payments are very expensive compared to what actually happens.

In reality, the fee is only to cover the cost of troubleshooting if and when something goes wrong. If you read the Bitcoin white paper, the author Satoshi Nakamoto references it.

Bitcoin’s on-chain transaction costs

Given that the creator of Bitcoin kept transaction costs in mind when creating a new reliable way to send money, surely Bitcoin’s shipping costs are small and completely transparent? The answer is yes and no.

First, you only pay for sending bitcoins, not receiving them. Second, Bitcoin shipping costs are not proportional to the value sent; What matters is how much data your event represents and how many other events are competing to be sent at the same time.

This focus on data volume comes from the fact that Bitcoin transactions are recorded on the blockchain, a decentralized digital ledger of data blocks, each of which has a fixed size (1MB). Every ten minutes a new block is added to this chain containing the latest transactions, which can only be spent after confirmation at the new address.

To confirm your transaction, a miner needs to add it to a new block of data, earning you payments for the service and a block reward.

Since there is only so much space in a block, miners prioritize trades based on total payout – choosing the highest – or how easy it is to add them to the block – choosing based on the least amount of data.

Luckily, you don’t have to do the math yourself, Bitcoin wallets usually use a dynamic fee option where you can choose whether to pay a regular fee if time isn’t critical or a priority fee if the transaction is time sensitive. . If not, there are many websites where you can find this information yourself.

If you really want to, you can come up with a custom payout calculation that specifies a specific amount calculated on a per-byte satoshi basis. It also helps to pay attention to network congestion by checking the Memory Pool (Mempool for short), where unconfirmed bitcoin transactions sit, waiting to be picked up by a miner and added to a new block. The clearer the Mempool, the less competition for confirmation, the lower the transaction costs.

On a side note, if you delve into transaction and payment tracking, you might be confused if you see confirmed blocks larger than 1MB. That’s because part of the solution to the block size battle was to find a way to avoid caching some transaction data in computer memory. So blocks can essentially be up to 1.7 megabytes in size.

What about stock trading?

What we’ve covered so far is for payments where you manage your bitcoins in a non-custodial wallet. If you’re not sure what that means, you can read our blog post on custody, but if you hold your bitcoins on a centralized exchange, for example, and you request a transfer, they’ll sort it out for you, and so the fee you pay will be determined. from the exchange, not from the bitcoin network.

Sometimes the exchange will simply charge fees at the going rate, in some cases they will charge a much higher flat fee to discourage withdrawals or to absorb fees as a promotional tool. It’s just important to be aware of the approach when using a custody service where you have no flexibility in the rates you pay.

How Bitcoin’s Focus on Decentralization Affects Payments

The lower the tldr for sending Bitcoins, the less you want to send, the higher the relative cost, even to the critical point where sending a few euros/dollars doesn’t make economic sense. But that is not the end of the story, as this would mean that most day-to-day transactions would not be possible on the Bitcoin blockchain, rendering it useless as a medium of exchange.

The problem stems from the need to limit the block size to maintain the decentralized nature of the Bitcoin network. It’s so important that it was a war albeit with tweets, not bullets. It’s a complicated topic, but for Bitcoin to be decentralized it should be easy for it to act as a node in its network – to authenticate transactions.

Nodes have to download the entire blockchain, and as we approach 80,000 blocks, this requires quite a bit of computational memory. The larger the block, the further away it is from using Node on a regular computer, and the less decentralized the Bitcoin network is.

Those advocating for a small block size won the Block Wars, leading to an update called Segregated Witness – or Segwit for short – which attempted to increase block efficiency by removing non-essential data rather than simply increasing the overall block size. block. Once the disputes settled, the focus shifted to ways people can trade off-blockchain, while avoiding paying fees to miners.

You can see the impact on payouts when mining is stopped by looking at April 2021, when a perfect storm of conditions in China, which accounted for a significant portion of mining power at the time, lowered the hash rate, a measure of the current mining capacity.

Blazing fast Bitcoin transactions with low fees

Transactions go back and forth through channels between Lightning Network users and are confirmed on the main Bitcoin blockchain when the channel closes and back and forth transactions are settled. Payments go to users who provide cash (credit) to facilitate transactions, so as the Lightning Network grows, you can use a proxy to transact with more people.

Bitcoin newcomers can sometimes be surprised by the price of transaction fees. This is because they don’t use a wallet that allows them to choose the right payment for the type of transaction and/or because they misunderstand how Bitcoin is supposed to work.