What Is Blockchain and How Does It Work?

Despite everything you’ve probably heard about Bitcoin, Ethereum, and other cryptocurrencies lately, many financial experts say it’s the technology behind cryptocurrencies that you really should be paying attention to.

“The underlying technology that most cryptocurrencies are built on, namely the blockchain, is a transformative technology,” said Lulea Demmissie, CEO of Ally Invest.

Some believe that blockchain technology has the potential to change nearly every aspect of our lives, far beyond the impact of cryptocurrencies on our financial wallets. Dr. Richard Smith, executive director of the Foundation for the Study of Cycles, a non-profit organization dedicated to studying patterns in economies and cultures, calls it a “revolution.”

Crypto skeptics also see the value of blockchain technology. The real gem is blockchain, says Chris Chen, CFP of Insight Financial Strategy in Newton, Massachusetts. He believes the blockchain will likely have much more staying power than popular cryptocurrencies like Bitcoin, which he calls lightning. “Blockchain continues to change the way we do things.

This all sounds great, but what exactly does it mean? Here’s what you need to know about blockchain and what the blockchain revolution could look like.

What is Blockchain?

Think of blockchain as a new form of digital governance. Blockchain is the underlying technology underpinning many cryptocurrencies, such as Bitcoin and Ethereum, but its unique way of securely storing and transferring information has broader applications beyond cryptocurrencies.

Blockchain is a sort of distributed ledger. Distributed ledger technology (DLT) allows data to be stored on multiple computers called “nodes”. Any user of the blockchain can be a node, but using it requires a lot of computing power. The nodes check, approve and store the data in the accounting system. This differs from traditional logging methods where data is stored in a central location, such as a computer server.

The blockchain organizes the data added to the ledger into blocks or groups of data. Each block can only contain a certain amount of information, so new blocks are constantly being added to the ledger, forming a chain.

Each block has its own unique identifier, a cryptographic “hash”. The hash not only protects the block’s data from anyone who doesn’t have the required code, it also protects the block’s position in the chain by identifying the previous block.

A hash is “a series of numbers and letters that can be up to 64 digits long,” said Vikas Agarwal, partner in PwC’s financial services advisory practice.

Once data is added to the blockchain and encrypted with a hash, it is permanent and immutable. Each node has its own record of the entire timeline of data on the blockchain going back to the beginning. If someone hacked or hacked into a computer and manipulated the data for their own benefit, they would not change the data stored by the other nodes. A modified record is easy to distinguish and correct because it does not match the majority.

“Because of the way the system works, it’s almost impossible for someone to duplicate the computation going on in the back to translate it and somehow figure out what all these hash values are,” says Agarwal.

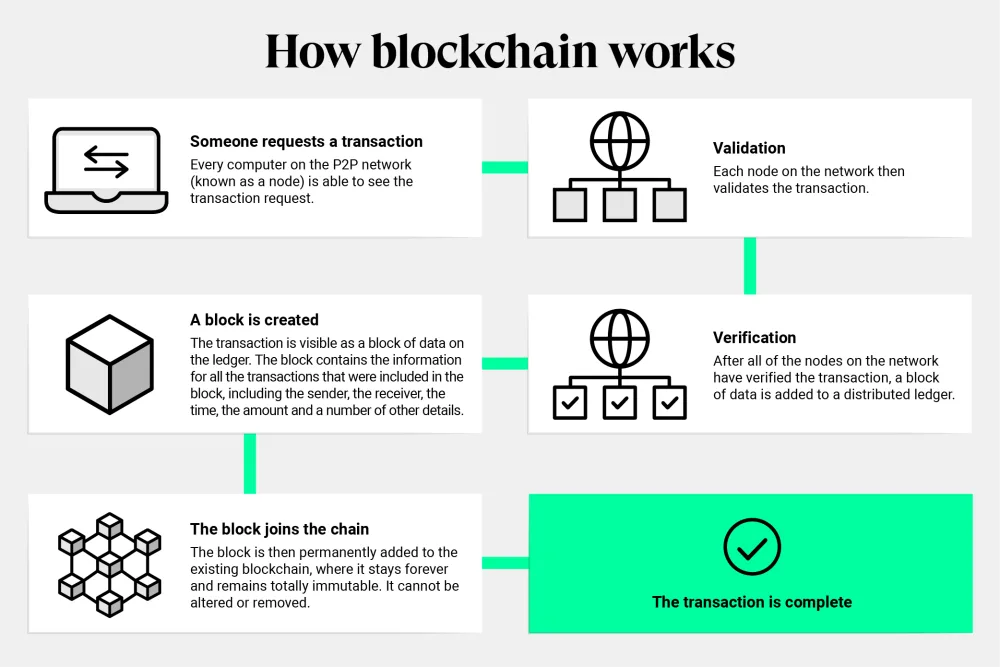

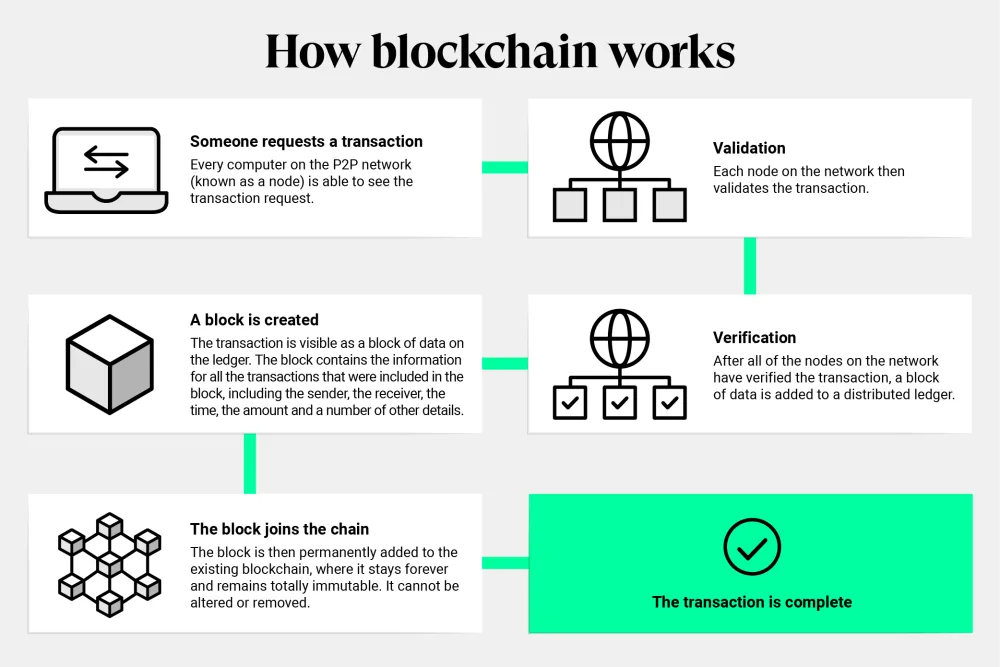

How does it work

Here is an example of how the blockchain is used to verify and record Bitcoin transactions.

- The consumer buys Bitcoin or Ethereum.

- Transaction data is sent through Bitcoin’s decentralized network of nodes.

- The nodes acknowledge the event.

- Once approved, the transaction is grouped together with other transactions into a block, which is added to the ever-growing transaction chain.

- The completed block is encrypted and the transaction record is permanent; it cannot be deleted or modified on the blockchain.

The Bitcoin blockchain is public, which means that anyone who owns Bitcoin can view their transaction history. While it can be difficult to identify the identity behind an account, the record shows which accounts are trading on the blockchain. Public blockchains also allow any user with the necessary computing power to participate as a node in accepting and posting transactions on the blockchain.

But not all blockchains are public. Blockchains can be designed as private ledgers so that the owner can limit who can make changes or additions to the blockchain. While the number of participants in a private blockchain may be smaller, it is still decentralized among the participants. Private blockchains keep the data stored in the database secure by using the same encryption methods.

The idea of secure, decentralized persistent data has sparked interest in a number of industries and has the potential to provide solutions to many of the security, record keeping, and data ownership issues we face today.

A future based on blockchain

Blockchain gives us the technology to transfer information securely, says Agarwal, and we have near-perfect certainty about the authenticity of any data we want to protect.

For example, he considers stories that have gone viral in recent weeks about memes and celebrities cashing in on digital assets by selling non-fungible tokens (NFTs).

Because the underlying blockchain record is immutable, NFTs allow sellers to verify the authenticity of digital assets. When you purchase an NFT, that transaction is added to the blockchain ledger and becomes verifiable property. For those looking to ensure the authenticity of a digital work, blockchain helps digital art and collectibles be valued in the same way as their physical counterparts. In theory, this causes creators to retain value by earning royalties on copies of digital art.

“It might seem confusing to the rest of us who don’t appreciate these things,” says Smith.

For many of us, one of the most impressive use cases for blockchain technology is the protection and secure transfer of personal data.

Imagine your bank details are stored on the blockchain. When opening an account with a new financial institution or transferring information between institutions, a blockchain ledger can help you quickly and securely ensure that the transfer or new account is correct and legitimate using the information already stored.

He predicts that blockchain technology has potential in almost any industry, “because every industry has some type of information that it seeks to exchange very securely.” In an electoral campaign organized with blockchain technology, it can be useful to have a locked voting register that cannot be modified later. Businesses can track more accurate inventory information using the blockchain. Blockchain can even help consumers make more informed purchasing decisions with more transparency in product supply chains. Technology can help food suppliers track recalls more effectively or allow consumers to avoid goods made using sweatshop practices.

Such applications illustrate the appeal of blockchain not only for security, but also for Chen’s data integrity. “Blockchain has the potential to give people more security and certainty about it,” says Agarwal.