Business

Basic Steps to Inflation-Proof Your Small Business

Two years into the Covid-19 pandemic, small businesses around the world are adapting to the challenges of the new normal. Gain a better understanding of the economic trajectory and how small businesses are adapting to labor shortages and supply chain challenges.

The economic problem that stands out today is the combined effects of global inflation and currency controls during this period. In fact, according to a Business.org survey, 60% of small business owners are concerned that high inflation will affect their finances.

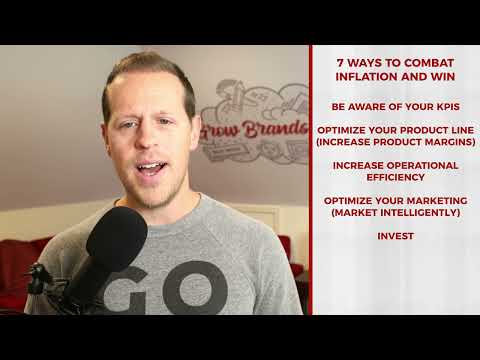

Here are his three key tips for entrepreneurs to make their Business news today inflation-proof.

How to inflate your small business

1. Understand what inflation means for your business

The first critical step in fighting inflation is understanding exactly how inflation affects your business.

- What are rising costs? Material costs, labor costs, rent, marketing costs?

- Are your competitors raising prices?

- What other trends are you seeing in your industry or market?

If your operating costs increase significantly and your competitors are raising prices, you know it’s time to introduce inflationary pricing. As a natural response to high inflation, prices of essentials such as grocery stores and gas stations increased, thereby passing the costs on to consumers. Your business should be ready to serve you in kind.

The next step when evaluating business operations is to think proactively rather than reactively. After raising the customer’s price, you can see if the price can be determined with the manufacturer, supplier, or business her partner. Closing long-term deals can save your business money and improve cash flow predictability in the long run.

Knowing the numbers is important. What are the actual operating costs? Which are fixed regardless of sales volume and which increase each time a product is sold? Knowing these details will help you plan correctly for the future can do. Many technology solutions are available today to help you understand costs and predict cash flow.

Where possible, you should focus on long-term preparation to find the right balance to keep your business healthy.

2. Build a healthy working capital

Once you understand the competitive landscape and cost ratios of your business, consider a proactive approach. Limited cash flow is one of the biggest challenges facing small businesses, so the next step is to obtain a line of credit for your business. Smart lending means you can get your money before you need it, so you can quickly remove potential financial hurdles in the future.

3. Plan your 90 days

If you haven’t met with your Financial planning services advisor to review your business plan in the last 90 days, make an appointment. In times of inflation, it’s important for businesses to be thoughtful and disciplined, including being prepared for market changes.

A key part of this process is a comprehensive review of business plans to address specific challenges in the current environment. Supply He chains is still short, so you may need to diversify your supplier base to better meet your inventory needs.

You’re probably thinking of your employees as well, and how the talent war will affect your business in the short and long term. What are your hiring and retention strategies to maintain consistent performance levels? What is it like?

Small business inflation prevention measures will pay off later

As the world recovers from the stagnation and recession caused by COVID-19, the small business landscape is expected to change.

By taking these steps, small business owners can manage the effects of a pandemic that can hinder real financial growth. You can also use it to sustain your company.