Crypto

How to Earn Interest on Crypto With up to 180% Yields

How to Earn Interest on Crypto With up to 180% Yields

Basics of earning crypto interest

Cryptocurrency markets are notorious for their inherent volatility. While this involves non-trivial risks, it also offers unique opportunities for earning returns and returns that a traditional equity investor might not even dream of.

These significant income opportunities have grown and become more accessible with the development of the decentralized finance (DeFi) industry. A real game changer has emerged with the rise of centralized cryptocurrency exchanges (CEX) and decentralized exchanges (DEX). Both strive to offer customers different financial products.

In this article, we’ll show you how to earn interest on cryptocurrencies and most importantly, how to choose investment opportunities that maximize your returns.

Keywords that allow you to earn interest on cryptocurrencies

Before we dive into the best opportunities to earn interest in cryptocurrencies, let’s discuss some of the key terms used in the crypto finance industry.

Annual Rate of Return (APY)

The annual rate of return (APY) is the annual interest you accrue on your investment, taking into account the effect of compound interest.

Market value

Market capitalization is a measure of the market value of a cryptocurrency, which is obtained by multiplying the current market price by the circulating supply.

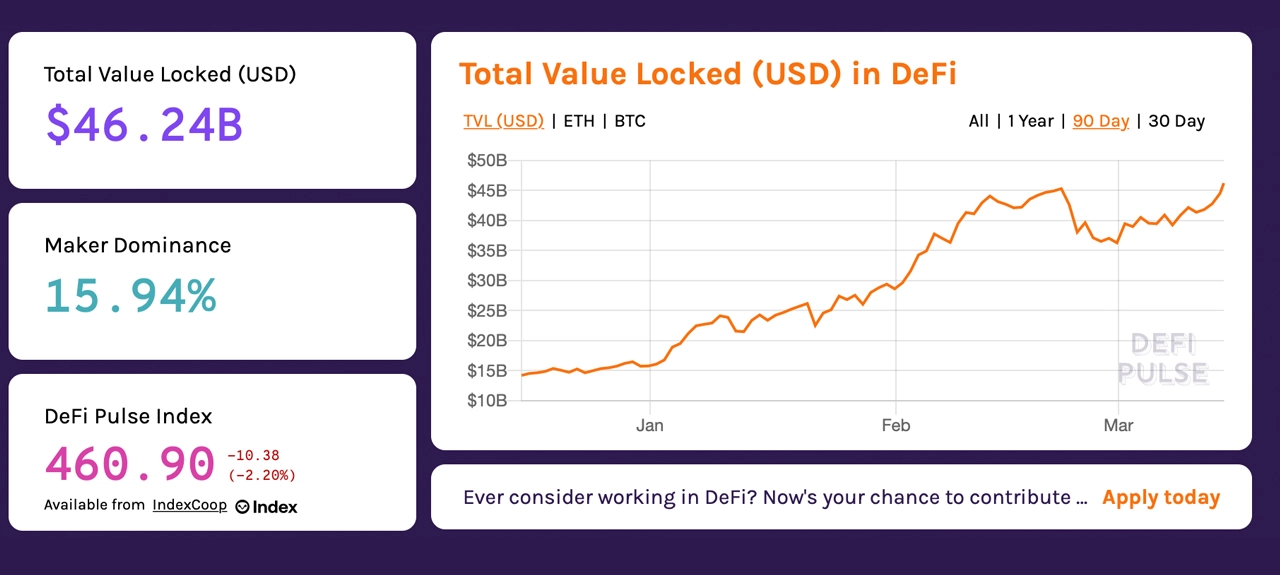

Total Locked Value (TVL)

Total Locked Value (TVL) refers to the total market value of all crypto funds currently locked into DeFi platform smart contracts.

Bear market

A bear market refers to a significant and usually prolonged decline in the market. A bear market is characterized by selling rather than buying among market participants.

Blockchains

Blockchain is a decentralized digital network that records transactions on the blockchain. All network participants/users jointly monitor the transactional activity of the blockchain. Most of the activities in the blockchain network – exchanging money between users, confirming transactions and conducting business – use cryptocurrencies.

Proof of contribution

Proof of Stake (PoS) is a consensus mechanism used in some blockchain networks to validate block transactions. In PoS blockchains, network users lock a certain amount of their cryptographic assets into the platform to get the right to confirm transactions and receive rewards.

Cryptocurrency staking

In a broad sense, cryptocurrency staking means locking up crypto assets on both centralized and decentralized platforms to generate revenue.

Cash extraction

Liquidity mining is the process of depositing your crypto assets into the liquidity pool of the DEX to receive rewards in the form of tokens and payouts.

A lasting loss

A permanent loss occurs when the price of an asset deposited in the liquidity pool decreases after it has been deposited.

How to earn interest on your cryptocurrency

The main ways you can earn interest on cryptocurrencies are staking and lending. Staking means locking your funds in a blockchain which helps confirm transactions and in return you earn cryptocurrencies from the platform. Additionally, some centralized platforms, such as betting providers CEX and Lido, also offer betting.

However, staking has gone beyond its original purpose and now often refers to numerous CEX and DEX investment products where funds are not specifically used for blockchain validation.

Borrowing means depositing money into a loan pool (and sometimes other types of pools) using DeFi lending and lending protocols and centralized cryptocurrency lending platforms.

Crypto Lending vs Staking

When considering crypto lending and betting, security and investment risks are essential for investors.

Safety

Betting is often considered a safer option than borrowing. After all, staking is a fundamental process in the blockchain network and is therefore well protected by the general blockchain security model. If staking on the blockchain fails, the entire blockchain along with all of its decentralized applications (DApps) will fail. Due to the critical importance of this contribution, its security is assured against all but the most serious hackers.

DeFi lending also happens in DApps on top of the underlying blockchain, introducing an additional vulnerability. In addition, DeFi lending carries some very specific security risks, such as direct lending attacks and eavesdropping.

Therefore, betting usually poses relatively less security threats to your money compared to borrowing.

Difference between risk and return

However, the risk-return ratio between contributions and lending is not necessarily clear. In general, established lending protocols such as Aave or Compound Finance offer lower interest rates on major, popular cryptocurrencies compared to conventional betting rates. However, some smaller lending platforms can offer very high interest rates, usually for highly volatile coins with low interest rates.

As with anything in finance, the higher the interest rate offered, the greater the risk associated with the investment. The risks of investing in very new, “dark horse” cryptos available on some lending platforms can be very high. Moreover, when you use DeFi lending protocols, you also face the possibility of permanent loss due to the volatility of crypto assets. Nevertheless, protocols generally help mitigate losses by distributing some of the trading costs to liquidity providers.

Guarantee

Another important factor when comparing premiums and loans is the collateral. Lending and lending platforms require borrowers to first borrow money as collateral for the amounts lent. Wagering, on the other hand, does not include collateral.

Stock market strikes vs. Strike on Blockchains

If you decide to stake your crypto assets, your two main options are through CEXs and/or joining a blockchain platform, which can be done directly by running a validation node or joining a stake pool.

Turn off blockchain

By using a blockchain validation node, you can earn stake rewards instantly. However, technical setup and minimum investment requirements are often significant. For example, to run a validation node on Ethereum, you must download the entire blockchain, be always online to avoid “slicing penalties”, and run all necessary software.

The financial requirements of validation nodes are also non-trivial. For example, Ethereum validators must wager a minimum of 32 ETH (approximately $43,000 as of 9/25/2022).

As an alternative to direct betting, you can join a betting pool that is managed by a betting provider and allows you to participate, with significantly lower technical and financial commitments. Unlike direct blockchain staking, participating in a staking pool makes you dependent on the operator of that pool.

Betting on CEXs

Instead of staking on the blockchain, either individually or through a pool, consider staking via CEX. For many crypto investors and users, the CEX route is more affordable, less risky, and less technically complex.

This is largely due to two major factors: safety of funds and customer support. Major CEXs are the largest crypto trading platforms in the industry. Their security settings and customer support provide significant advantages over blockchains and DApps.

Any possible hacker attack on the blockchain can lead to possible loss of funds. At the same time, you can use a custodial wallet in a major CEX, so your money is less at risk of being hacked. Of course, CEXs are not immune to hacker attacks. However, in the larger companies, cybersecurity is a critical part of their business model. Thus, the custodial wallets for these CEXs are relatively more secure compared to non-secure blockchain wallets.

CEX Contribution can also help you get investment products with more stable and predictable interest rates and terms. It can also be an easier way for novice investors to enter the world of crypto betting. In addition, CEX staking allows you to use coins that are not normally “stakeable” through the blockchain platform.